About Seasonal Tokens - Ethical & Non-Speculative Wealth Creation

Seasonal Tokens can be described as an ethical and non-speculative tool for building wealth in the form of digital assets (tokens). They do not eliminate the risk of making a loss measured in dollars or any other government backed fiat currencies. But they allow the user to accumulate tokens over time by trading, and make it possible to eliminate the risk of making a trading loss measured in tokens. There are four trustless, decentralized tokens, mined using Proof-of-Work. They’ve been designed so that their prices will cycle around each other over the course of years, allowing users to gain more tokens over time by trading the more expensive tokens for the cheaper ones.

By following the rule: always trade tokens for more tokens of a different type, a trader can guarantee that the total number of tokens owned will increase with every trade. This makes it possible to accumulate tokens over time without risking a loss measured in tokens. The number of tokens that a trader owns goes up and never goes down.

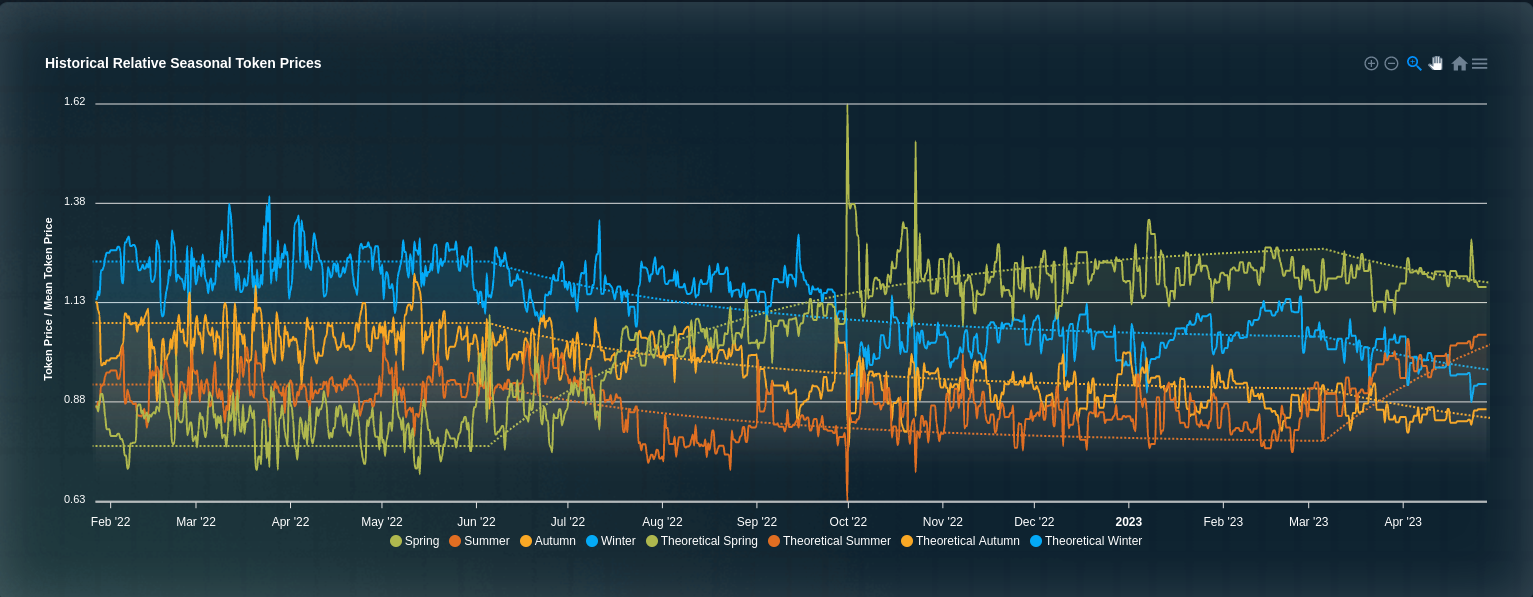

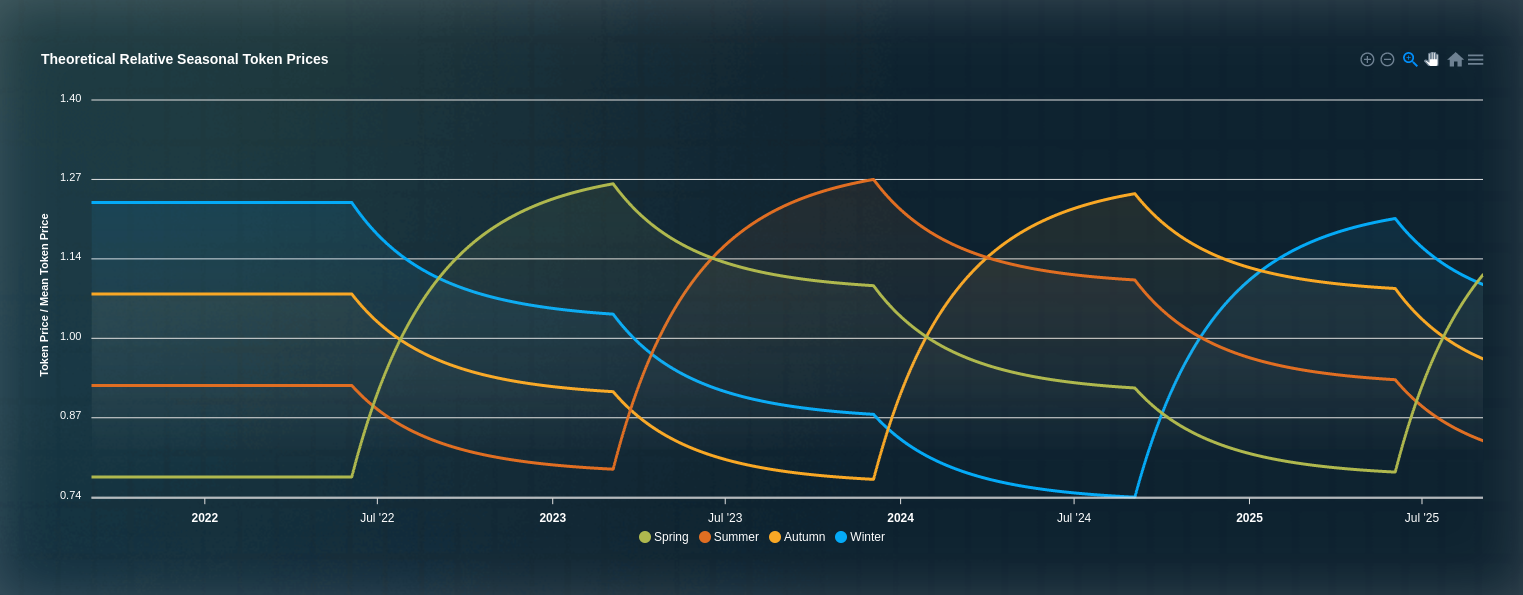

The historical price chart below shows how the token prices have behaved since farming began at the start of 2022. The prices are cycling around each other as intended.

The theoretical price chart below shows how the prices can be expected to evolve over the coming years, presuming that the market reacts to future halvings at the same rate as it did to the Spring halving in June 2022, and the Summer halving in March 2023.

The cycles in the prices allow traders to accumulate tokens over time through trading. A trader who started with 5 Winter tokens could have exchanged them for approximately 8 Spring tokens before June 2022. Those 8 Spring tokens could then have been traded for approximately 13 Summer tokens just before the Summer halving in March 2023.

As time goes on, those Summer tokens are expected to become the most expensive, and might be traded for 18 Autumn tokens in the future, which could possibly be traded for 23 or more Winter tokens later. Trading the tokens in a cycle over the course of three years could potentially allow a trader to turn 5 Winter tokens into 23 or more.

This outperforms the buy-and-hold strategy, allowing users to accumulate wealth over time in the form of tokens. Even though the dollar prices of the tokens are not guaranteed to increase, a trader with 23 Winter tokens has more wealth than a trader with 5.

Because they allow users to outperform buy-and-hold without the risk of ending up with fewer tokens than they started with, the tokens have a utility: Building wealth.

Learn about The Utility of Seasonal Tokens

- A trader can make a loss by buying tokens and then selling them at a lower price. The future prices of the tokens measured in dollars cannot be guaranteed or predicted. There is a risk of loss when buying and selling the tokens.

- The number of tokens owned by the trader can be made to increase with every trade, but the value of those tokens measured in dollars is not guaranteed to increase.

- The trader can build wealth in the form of acquiring more tokens over time, but the trader’s wealth measured in dollars is not guaranteed to increase.

- The tokens are designed so that their prices will cycle around each other, but this depends on a model of how market prices react to changes in supply. Future market prices are not guaranteed and may behave differently.

- The risk of making a trading loss measured in dollars cannot be eliminated. Only the risk of making a loss measured in tokens can be eliminated.

Watch our Latest Video Update - To Learn 'How To Create Wealth'!

As the prices slowly cycle around each other, the economy goes through alternating periods of profit-taking and waiting for the seasons to change. Our video updates explain the current state of the economy, and which trades investors can make to gain more tokens over time.

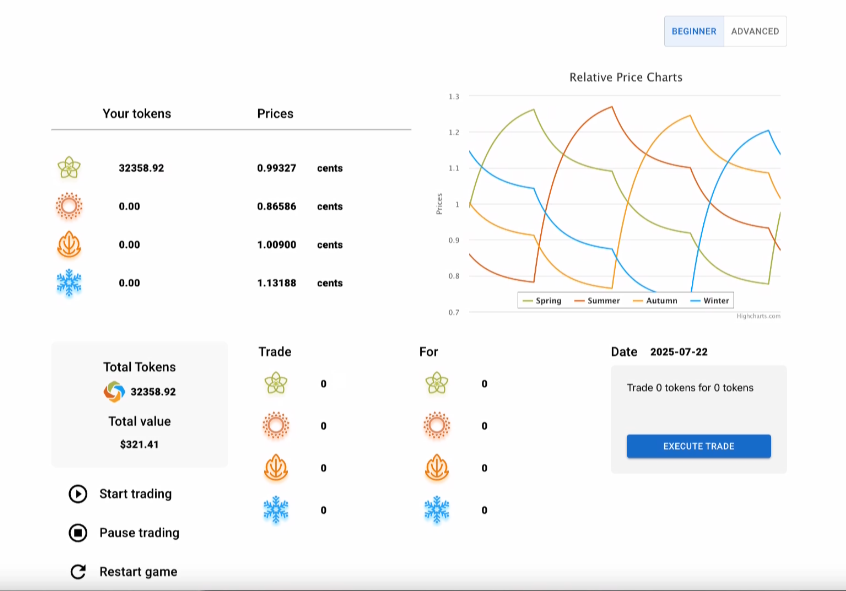

Try the Trading Simulator - Practice Without Risking Funds!

The Seasonal Tokens Trading Simulator allows users to practice trading tokens for more tokens over time as the prices cycle around each other, without putting any real money at risk. Use the simulator to see how many tokens you can acquire over the course of ten years by trading tokens for more tokens, as the prices cycle around each other.

More information about the simulator is available in the Simulator FAQ.

More information about the simulator is available in the Simulator FAQ.

Cryptocurrencies offer unprecedented new opportunities for generating wealth, but nearly all cryptocurrency based projects are based on speculation. Buyers hope to profit by predicting how the market prices will change over the short to long term, and these predictions may be correct, but also, may be incorrect. Trading or holding these speculative assets is effectively gambling and carries a high risk of loss. The proliferation of cryptocurrencies over the last few years has produced enormous profits for some, but has left a much larger number of people with large losses.

In its current form, the industry unethically forces cryptocurrency investors to gamble, and transfers wealth from poorly-informed outsiders to insiders who have better information. The problem that needs to be solved is to remove the gambling aspect from cryptocurrency trading, so that it’s possible to build wealth over time without speculating on the future occurrence of uncertain events. A system of cryptocurrencies is needed that allows users to steadily build wealth without relying on the expectation that someone else will buy those assets later at a higher price.

Seasonal Tokens constitute an 'Ethical & Non-Speculative Wealth Creation Tool', which allows users to accumulate wealth in the form of tokens without the need to speculate. Instead of betting on future demand, which is highly uncertain, users take advantage of the predictable changes in supply, which are programmed into the smart contracts, making them both pre-determined and unchangeable.

Because the rates of supply are completely predictable, everyone knows in advance which token will tend to be the cheapest, and which will tend to be the most expensive at a future point in time. This makes it possible to trade the tokens “on autopilot”, gaining more tokens in total with each trade. By always trading tokens for more tokens of a different type (e.g. trading 3 Spring tokens for 5 Summer tokens), users can eliminate the risk of ending up with fewer tokens than they started with. The number of tokens in the user’s portfolio will increase over time and not decrease.

Accordingly, the tokens provide a non-speculative and risk-reducing strategy for accumulating further tokens over time. This removes the gambling aspect from cryptocurrency trading, and provides an ethical and sustainable way to build wealth, in the form of tokens, using cryptocurrency trading. The value of a trader’s holdings measured in dollars or any other government backed fiat currency, is not guaranteed to increase, but a trader who gains more tokens over time will have more wealth in tokens than a trader who doesn’t, regardless of the dollar price.

NB: It’s important for potential buyers to understand that the risk of making a trading loss measured in dollars cannot be eliminated. Only the risk of making a loss measured in tokens can be eliminated.

Reducing Risk

There is a risk of making a loss measured in dollars, because the dollar prices of the tokens could decrease. However, a trader who turns 5 tokens into 10 tokens by trading is less likely to make a loss than a trader who simply holds the 5 tokens. When the tokens are used for their intended purpose, the risk of making a loss decreases.

Profit Without Inflicting a Loss

There is no need to inflict a loss on another trader in order to make a profit. By trading tokens for more tokens over time, traders take advantage of the changing rates at which new tokens are produced. They don’t take tokens from other traders.

Removing Speculation

Traders who want to accumulate bitcoins and dollars over time by trading between them must bet on future price changes. They risk ending up with fewer dollars and bitcoins. Traders who accumulate tokens by trading expensive ones for cheaper ones, do not need to bet or speculate, and can eliminate the risk of ending up with fewer tokens.

Rewarding Patience

Users can benefit from the tokens by patiently holding them for a period of nine months, and then trading them for the next token in the cycle.

Fair Distribution Method

The tokens can only be produced by mining. Even the founders of the project need to buy or mine tokens to acquire them, just like the rest of the community.

Transparent & Decentralized

Nobody has any more control over the tokens than anyone else. All of the tokens that exist are mined, and the proof of work is publicly visible on the Ethereum blockchain.

The prices of the tokens are intended to cycle around each other due to changes in supply. Once every nine months, the rate of production of one of the tokens is halved, and the market price of that token is expected to increase relative to the other tokens over the subsequent months. Analysis of the price history has shown that, after each halving, the prices have moved approximately 1% daily towards their new target ratio based on the rates of production. However, there is no guarantee that prices will behave this way in the future.

The theoretical price chart and the prices used in the simulator are based on the assumption that the prices will continue to behave this way. The prices of the tokens measured in dollars will depend on demand and accordingly, if the tokens become more popular, then the dollar prices may rise. On the other hand, if they become less popular, then the dollar prices may fall. Changes in demand are not necessary for the tokens to cycle around each other in price, because this effect is driven by supply.

Predictable Price Rises

Four tokens - Spring, Summer, Autumn and Winter - have been designed to increase in price relative to each other in a predictable sequence that repeats itself. Spring will tend to go up in price, then Summer, then Autumn, then Winter, then Spring again. It's the times of the price rises that are predictable, when that time comes, the price is expected to rise, based on the decrease in supply. That said, future prices can not be guaranteed, in any event.

Designed For Seasonal Trading

Trading is potentially profitable if the tokens you buy rise in value and quantity after you buy them and before you sell them, knowing when to buy and when to sell is the hard part of trading. Seasonal Tokens make this easier, as tokens that may rise in price next can be bought, and then traded for the next token in the cycle after the price has risen. By participating in the seasonal trade of the tokens, a buyer can continually increase the total number of tokens that he or she owns over time.

Designed For The Long Term

Unlike short term pump-and-dumps, that are effectively driven by crowd behavior, the Seasonal Tokens are designed to potentially rise in price over the course of many months, driven by long term changes in supply and demand. Reduced mining supply, and increased farming demand, for each token, are allowed to affect the market for nine months, putting a potentially sustained upward pressure on the price, after which the next token in the cycle goes through the same process.

Seasonal Supply and Demand

Tokens are produced by mining, and are used for trading and farming. The relative supply of the four tokens is controlled by mining, and the farm creates demand for the tokens in specific proportions. Rules have been arranged so that each token will face a combination of higher demand and lower supply over the period when its price is intended to rise in comparison to the others. When a token is "in season", it's programmed to be produced at the fastest rate of the four, and when it goes out of season, it's produced at the slowest rate. Four months after a token goes out of season, the potential demand from farming increases. The farm switches from paying out the least for that token to paying out the most.

Seasonal Tokens Use Cases

- Seasonal Trading

- By holding Spring tokens while their price rises in comparison to the others, and then trading them for Summer tokens, and holding them while their price rises, and so on, a trader can always hold a token whose price is tending to rise relative to the others, allowing them to increase the number of tokens they own over time.

- Farming

- A buyer with Spring tokens, can use them to provide liquidity and then stake that liquidity position in the farm. That buyer will then receive Spring, Summer, Autumn and Winter Tokens, for as long as the liquidity is left in place. 9% of tokens mined are distributed to farmers.

- Donating to the Farm

- Donating tokens to the farm helps to support the value of the tokens by incentivizing liquidity providers. The farm also contributes to the rotating demand for the tokens, making it potentially more profitable to trade them in a cycle. So donating tokens can be expected to potentially support their price and drive rotating demand.

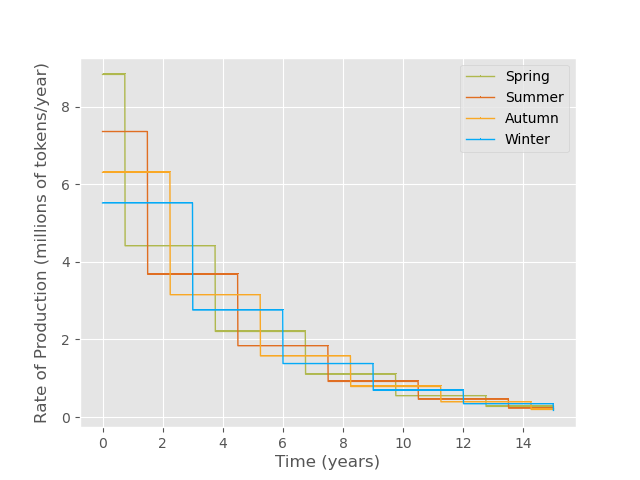

Seasonal Mining Supply

Miners earn rewards of newly-mined tokens every ten minutes on average. The number of tokens per reward are shown in the table below. Mining started on the 5th of September, 2021 and Spring tokens were in season. Each token has undergone one halving: Spring in June 2022 (168→84), Summer in March 2023 (140→70), Autumn in December 2023 (120→60), and Winter in September 2024 (105→52.5).

| Spring | Summer | Autumn | Winter | |

|---|---|---|---|---|

| September 2021 | 168 | 140 | 120 | 105 |

| June 2022 | 84 | 140 | 120 | 105 |

| March 2023 | 84 | 70 | 120 | 105 |

| December 2023 | 84 | 70 | 60 | 105 |

| September 2024 | 84 | 70 | 60 | 52.5 |

| June 2025 | 42 | 70 | 60 | 52.5 |

| March 2026 | 42 | 35 | 60 | 52.5 |

All four tokens have now undergone their first halving cycle. Spring halved in June 2022, Summer in March 2023, Autumn in December 2023, and Winter in September 2024. The cycle now continues with each token being produced at its reduced rate until the next halving occurs in approximately 3 years from each token's last halving.

The chart below shows how the rates of production of the tokens change over time. Approximately 37 million tokens of each type will be produced in total.

In accordance with the EU's Markets in Crypto-Assets Regulation (MiCA), we have adopted a strategy for our proof-of-work tokens to mitigate the environmental and economic impacts of mining.

- Our mining algorithm (Keccak), is ASIC-friendly.

- This reduces power consumption drastically in comparison to mining performed on consumer hardware.

- Over the long term, ASIC-friendly mining algorithms tend to lead to centralization of mining at power production facilities.

- This makes it cheaper to produce energy, without adding to energy usage by consumers.

- Unlike mining performed on consumer hardware, centralized mining facilities can be regulated to ensure that environmental impacts are minimized.

Independent Analysis

An independent financial expert, has conducted a peer-reviewed analysis of the Seasonal Tokens token economics and has compiled a report, which is available for all potential partners, our community and the general public to view here: International Journal of Cryptocurrency Research, Volume 3, Issue 1, June 2023

Artificial Intelligence Analysis - GPT-4

GPT-4 has demonstrated that it understands the concept of the 'Seasonal Tokens', and has characterized the tokens as:

- A tool for building wealth,

- A financial innovation,

- An accessible investment option,

- A risk management tool, and

- A long-term investment strategy.

Additionally, GPT-4 has stated the following:

- The concept "is unique and has not been observed in previous financial markets."

- The concept “seems to be a more innovative and intentional approach to creating cyclical trading opportunities.”

- It “seems that the creation of seasonal tokens is ethical. The tokens are designed with transparency, fairness, and financial inclusion in mind.”

- “Seasonal tokens seem to align with ethical requirements of Islamic finance.”

NB: It's important to note that GPT-4 is a new technology and has been known to make reasoning errors and false statements.

After a successful first audit in Q3 2021 of the smart contract code, which was completed and no apparent security issues found, our team began a phase of public testing before launching the 'Seasonal Tokens' on Ethereum's main network. A bug bounty was offered to anyone who could find a security issue with the smart contracts. During the public testing period, a second audit was conducted, which again revealed no apparent security vulnerabilities.

Accordingly, the tokens were deployed and mining began on the 5th of September, 2021. Since then, the community of miners, traders and farmers has grown, and the tokens are now listed on all major token-tracking websites, including CoinMarketCap and CoinGecko, and have received widespread global media coverage.

The easiest way to buy and trade the tokens is to use MetaMask. This video shows users how to get started quickly.

The tokens can be bought and traded on the Ethereum network and on Polygon. Once MetaMask has been installed, the buttons above can be used to add the tokens to your wallet. Then it's possible to swap other cryptocurrencies for Seasonal Tokens using MetaMask's swap functionality.

When trading one type of Seasonal Token for another, investors can follow the rule: Always trade tokens for more tokens of a different type. This guarantees that the total number of tokens in the investment increases with every trade.

See Our Extensive Media Coverage - We're Going Global!

Roadmap - We Implement Our Strategic Goals, On Time, All The Time!

FAQ - Questions about Seasonal Tokens!

Seasonal investors need prices that reliably cycle around each other to profit from their preferred investing strategy. Most seasonal investors seek stocks or commodities with regular cycles in their prices, which can be traded for profit.

The Seasonal Tokens are cryptocurrencies engineered to have the properties that seasonal investors currently seek among stocks and commodities. Their prices cycle around each other slowly and predictably, making them suitable for use as seasonal investments.

Before June 5th, 2022, the amounts of time needed to produce the four different tokens by mining had the ratio 5:6:7:8. Five minutes of mining Spring, 6 minutes of mining Summer, 7 minutes of mining Autumn, or 8 minutes of mining Winter, all produced the same number of tokens.

The theoretical prices are based on the same ratio. After the Spring halving in June 2022, the ratio of the times needed to mine the tokens changed to 10:6:7:8, and the prices began to drift towards this new ratio. After the Summer halving on March 6th, 2023, the ratio changed to 10:12:7:8. Following the Autumn halving in December 2023 (10:12:14:8) and the Winter halving in September 2024 (10:12:14:16), the prices continue to adjust to these new ratios.

Based on how the prices reacted to the Spring halving, it's estimated that the prices move about 1% per day towards their target ratio. The theoretical prices shown on the charts page are calculated by assuming that the market will respond at the same rate to future halvings.

The white paper is available here.

Three independent teams of auditors have examined the code to ensure that it does exactly what it's intended to do. Links to the audits are available here:

Each token's rate of production is halved every three years. The three years of constant supply allow the market enough time to find an equilibrium between supply and demand. After the supply is cut in half, the number of tokens of that type that exist will fall short of the amount needed to sustain the previous equilibrium, and this shortfall will increase in size over time until the market adjusts to the reality that the previous equilibrium can't be sustained.

The halvings of the tokens occur at nine month intervals. Nine months after the Spring halving, the rate of production of Summer tokens halves. This will cause the price pressure from the reduced supply to affect each token nine months after the previous token. Accordingly, the tokens will tend of increase in price one after another, in a systematic, predictable and regular manner.

It takes several months after a halving for the market to adjust to the lower rate of production. Nine months was chosen as the interval so that there would be enough time for the previous equilibrium between supply and demand for a token to be disrupted, and for the price to respond, before the next token in the cycle goes through the same process.

When there's a constant quantity of something, a trader who acquires more of it leaves less for everybody else. But when the quantity increases over time, it's theoretically possible for everyone who trades to end up with more than they started with.

The number of bitcoins and US dollars in the world is increasing, and so it's theoretically possible for everyone to trade and end up with more of both. In practice, though, it's not clear what trades to make to consistently get a share of the new dollars and bitcoins. It's theoretically possible, but it's impractical because neither bitcoins nor dollars were designed for it.

Seasonal tokens are continually produced by mining. The rates at which the tokens are generated have been designed to make it possible for everyone to acquire some of the new tokens, by trading them cyclically. Everyone knows what trades to make to do this. Cyclical trading is the type of trading that allows traders to take advantage of the influence of new tokens on the market, and to trade profitably without inflicting a corresponding loss on other traders.

Of course, it's still possible to make a trading loss, for example by trading the tokens in the wrong direction. Nobody is guaranteed that every trade they make will be profitable. But it's mathematically guaranteed that if you always trade tokens for a greater number of tokens, e.g. trade 3 Spring tokens for 5 Summer tokens, then you will have more tokens in total after the trade than before.

There's no guarantee of that. It's the prices of the tokens relative to each other, not relative to USD, that are driven by the rotating supply and demand. New tokens are introduced to the market by miners, and trading the tokens in a cycle makes it possible to scoop up some of the newly-mined tokens as they're added to the market in different quantities at different times.

Doing this allows investors to make a profit measured in tokens. The value of their investment after doing this is greater than it would be if they simply held onto the tokens they have.

It may not be greater than it would be if they sold their tokens and invested in something else entirely, such as USD. However, the tokens are running out and becoming harder to obtain over time. The increasing scarcity of the tokens, and the fact that the cost of the mining equipment and electricity needed to produce a token is inexorably rising over time, makes it likely that they will have a higher USD price in the future. Of course, this can't be guaranteed.

Market prices depend on the behavior of many people, and it's impossible to make guarantees about what people are going to do and what will happen in the future.

The cost of producing a token doubles after a halving, and the rate of production halves. When the farm payout switches 4 months later, the token becomes more valuable for farming. These changes in supply, demand, and the cost of production can be expected to result in upward pressure on the price of that token relative to the other three tokens. Nobody, however, can ultimately guarantee future prices and events.

Users can develop an expectation that these relative changes in price will occur by using their own understanding of how market prices react to changes in supply and demand. Up to the present date, the prices have been cycling around each other as expected. That said, there is absolutely no entity that can make any guarantee of this, to any users, and accordingly, there is no entity that is liable for user losses (in any eventuality).

If an investor only trades tokens for a greater number of tokens of a different type, then it is guaranteed that, after the trade, the investor will have more tokens in total than before. This is guaranteed by mathematics, not by any entity making a promise or agreement with the investor.

So it is guaranteed that an investor who does this will not make a loss measured in tokens. The total number of tokens owned by that investor will increase and not decrease with every trade.

However, there is no guarantee that the value of the investment measured in USD or another currency will never decrease. Sometimes the USD price of a token will rise, and sometimes it will fall. The risk of ending up with fewer USD after investing in, and subsequently selling, the tokens, cannot be eliminated.

As mentioned previously, only the risk of ending up with fewer tokens can be eliminated.

Is it guaranteed that there will be opportunities to cyclically trade and gain more tokens in total?

Nobody can guarantee future prices, but for there to never be any opportunities to cyclically trade, and gain more tokens, the prices of the tokens would need to be exactly equal to each other, and remain that way indefinitely.

The different rates and costs of production of the tokens make such a scenario unlikely. There are more Spring, Summer and Autumn tokens than Winter tokens in existence, and they all can be produced by mining more cheaply than Winter tokens. Spring, Summer and Autumn tokens together make up about 80% of all existing tokens, with Winter tokens making up the remaining 20%. There are only enough Winter tokens in the world for one quarter of the other existing tokens to be traded for them at a 1:1 rate.

Because everyone knows that Winter tokens are scarcer, and more expensive to produce, than the other tokens, traders are likely to trade other tokens for them at 1:1 rates in the largest quantities they can, knowing that the market can't continue to supply them at that price indefinitely.

There is no single day to trade tokens of one type for the next token in the cycle. The scarcity caused by a halving needs months to accumulate before it can affect the price. Different investors will make the trade at different times, over a period of months.

During this time, the farm will be paying liquidity providers, which will ensure that there is liquidity available for cyclical traders to make their trades.

As of September 2024, the current production rates are: 84 Spring, 70 Summer, 60 Autumn, and 52.5 Winter tokens every 10 minutes on average. These rates reflect the halvings that have occurred since mining began in September 2021.

None. The founders need to buy or mine tokens like everybody else to acquire them.

All of the expenses involved in developing the project were paid for by the founders. Nothing is owed to them.

The only way the founders can profit is if the tokens they mine or buy become more valuable over time. The founders bore the expense of creating the tokens, while giving everyone the same opportunities to invest and profit, because they believe the tokens are genuinely good investments.

The tokens can be traded for ETH on Uniswap, using the buttons on the trade page.

The easiest way to buy and trade the tokens is to add the tokens to MetaMask using the "Add to MetaMask" buttons above. After this has been done, other digital assets can be traded for the tokens using MetaMask's swap functionality.

Seasonal Tokens leverages the benefits of smart contracts running on the ethereum network. Once executed, these smart contracts are immutable, meaning their rules and parameters cannot be changed. This ensures transparency, eliminates the need for human involvement and provides security for the production and trading of Seasonal Tokens.

On the Ethereum network, the contract addresses are:

spring: 0xf04aF3f4E4929F7CD25A751E6149A3318373d4FE

summer: 0x4D4f3715050571A447FfFa2Cd4Cf091C7014CA5c

autumn: 0x4c3bAe16c79c30eEB1004Fb03C878d89695e3a99

winter: 0xCcbA0b2bc4BAbe4cbFb6bD2f1Edc2A9e86b7845f

On the Polygon network, the contract addresses are:

spring: 0x70d59baA5ab360b2723dD561415bdBcD4435E1C4

summer: 0xdd28ec6b06983d01D37DbD9Ab581d8d884d95264

info@seasonaltokens.io